Midland Bookkeeping Prices: What SMB Owners Actually Pay (2025 Guide)

A plain-English price guide for Midland small businesses.

Running a business in West Texas is demanding—you shouldn’t also have to guess what bookkeeping should cost. This guide gives Midland small-business owners a clear, transparent look at typical monthly prices and what actually drives them.

TL;DR: most SMBs pay $250–$1,000 per month for ongoing bookkeeping, depending on the number of bank/credit card accounts, transaction volume, payroll coordination, and any light AR/AP support. It’s written for

trades (HVAC, plumbing, landscaping),

professional services (contractors, agencies, clinics), and

retail/e-comm (brick-and-mortar + Shopify/Stripe). No fluff—just plain-English ranges, inclusions vs. add-ons, and quick calculators so you can benchmark quotes fast.

Want your exact price? Get a 10-minute quote and we’ll review your setup today.

Why Fixed-Fee Beats Hourly (for Busy Owners)

Fixed-fee bookkeeping keeps your costs clear and your calendar sane. With a set monthly price, you’re not watching the clock or bracing for surprise invoices. Your provider is rewarded for building smart rules and automations (not for dragging tasks out), and you get a consistent month-end close you can run the business on.

Predictability (no surprise invoices).

Know the number before the work starts. Budget it. Forget it.

Efficiency incentives (rules/automation > billable hours).

Fixed fees push us to build bank rules, tidy your chart of accounts, and streamline imports—so the work gets faster and your books stay cleaner.

Scope clarity (deliverables + deadline).

You should get a written scope and a

month-end close target (5 business days). That rhythm turns “I’ll do it Sunday” into reliable, on-time reports.

When hourly still makes sense (edge projects).

- Catch-up/clean-up for many months behind

- One-time migrations (e.g., moving to QuickBooks, POS/e-comm integrations)

- Forensic/audit support or unusual deep dives

What you should get for a fixed fee

- Bank/credit card reconciliations every month

- Tidy chart of accounts + bank rules maintained

- 5-day month-end close target

- Owner-ready reports: P&L, Balance Sheet, simple cash view

- 15–30 min monthly review call highlighting what matters (cash, costs, next steps)

Net-net: Fixed fee = clear price, faster work, reliable close. Use hourly for true one-off projects; keep the monthly rhythm fixed.

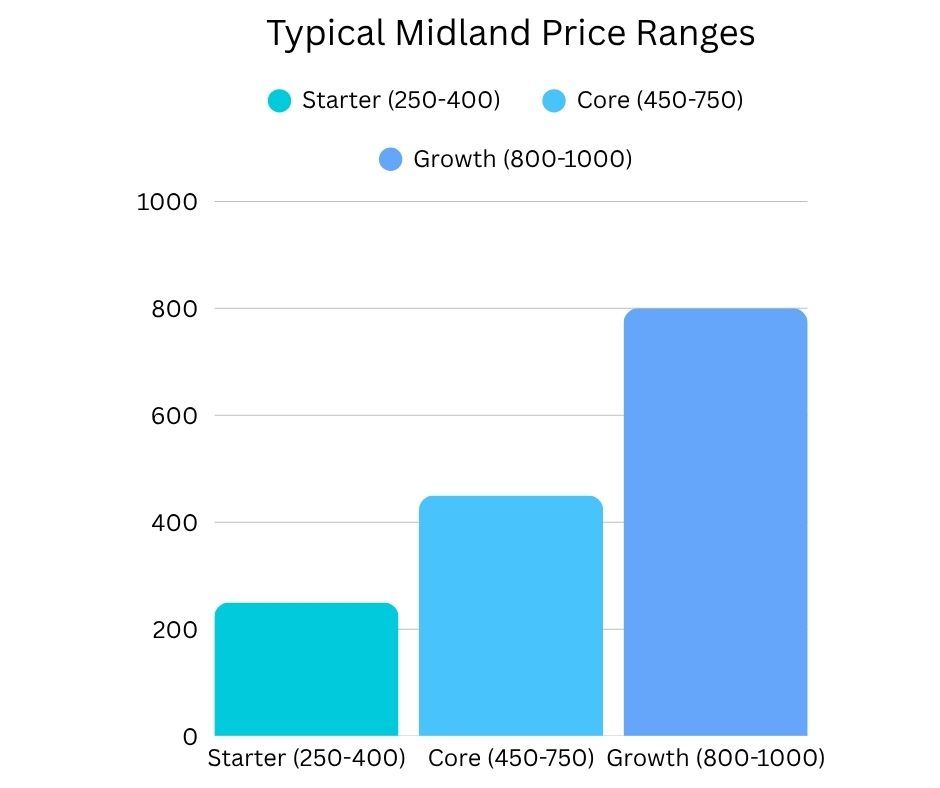

Typical Midland Price Ranges

Most Midland SMBs land in one of three buckets. Your exact quote depends on accounts, volume, and a few add-ons—but this gives you a fast benchmark.

Starter — $250–$400/mo

For low volume and a simple setup (1–2 bank/credit card accounts). Monthly reconciliations, tidy chart of accounts, owner-ready P&L/Balance Sheet, and a light monthly review.

Core — $450–$750/mo

For moderate volume or added coordination. Includes Starter + basic payroll coordination and

AR/AP light (owner-approved invoicing/reminders and bill scheduling). Good fit for most trades and professional services.

Growth — $800–$1,000/mo

For higher volume, mixed sources (e-comm/POS), or light job costing/class tracking. Includes Core plus extra reconciliation/review time to keep multi-channel numbers clean.

What moves you up or down

- Accounts: More bank/credit card accounts = more reconciles and rules to maintain.

- Transactions per month: Higher volume or messy imports require more review time.

- Payroll coordination: Multiple schedules, job costing, or frequent edits add lift.

- AR/AP light (owner-approved): Invoicing/reminders and vendor bill scheduling push toward Core/Growth.

- E-comm/POS integrations: Shopify, Square, Stripe, or payout reconciliations add complexity.

- Catch-up/Clean-up (one-time): Months behind are quoted separately, then you drop to normal monthly.

What Should Be Included (and What’s Not)

A good monthly bookkeeping plan is clear about what you get—and what’s outside the scope—so there are no surprises.

Included (monthly)

- Bank/credit card feeds & reconciliations

We connect feeds, categorize, and tie out every account each month. - Tidy chart of accounts + bank rules maintenance

Clean categories and smart rules to keep everything consistent. - 5-day month-end close target

A reliable rhythm so you’re never waiting on numbers. - Owner-ready reports (P&L, Balance Sheet, simple cash view)

Straightforward reports you can actually use to make decisions. - Light AR/AP (owner-approved) + payroll coordination

Invoice reminders and bill scheduling with your approval; we coordinate payroll inputs/edits. - 15–30 minute monthly review call

Quick rundown of cash, costs, and what to fix next.

Not included / add-ons

- Bill pay / collections (we don’t move your money)

- Sales-tax filing & income-tax prep (we coordinate with your CPA/EA or refer partners)

- Inventory management beyond basics (no perpetual inventory or advanced costing)

- Forensic/audit response projects (deep dives, audits, investigations)

Red Flags When Comparing Providers

Choosing a bookkeeper is easier when you know what to avoid. Watch for these deal-breakers when shopping for a bookkeeping service in Midland, TX:

- Hourly only, no written scope.

You’re signing a blank check. Insist on a fixed monthly price with clear deliverables. - No stated close deadline.

If there’s no month-end target (e.g., 5 business days), your books will drift and decisions get delayed. - Vague or delayed reporting.

You should get an owner-ready P&L, Balance Sheet, and simple cash view every month—on time. - No card/ACH on file.

If they won’t auto-draft, you’ll end up chasing invoices and dealing with stop-start service. - No onboarding plan.

A pro has a checklist: QBO Accountant invite or last 3 months of statements, COA tidy-up, bank rules, and a go-live date. - Unwilling to quote catch-up separately.

Clean-up is a one-time project. If it’s buried in monthly fees, expect surprises later.

Pro tip

Ask this: “What’s your month-end close deadline, and what happens if you miss it?”

You want a clear answer, in writing.

Quick Price Calculator (2 Real-World Scenarios)

Use these ballpark ranges to sanity-check quotes. Your exact price depends on accounts, volume, payroll, and AR/AP needs.

| Scenario | Accounts | Monthly Txns | Payroll | AR/AP | Est. Range |

|---|---|---|---|---|---|

| Trades: HVAC (6 techs) | 3 | ~350–450 | 2 payrolls | Weekly invoices + reminders | $450–$750/mo |

| Retail + Online (Shopify) | 4 | ~600–800 | 1 payroll | Vendor bills weekly | $700–$1,000/mo |

Rule-of-thumb adders: +$75–$150 per extra 1–2 accounts or +200–300 transactions/month; +$100–$200 for AR/AP light & payroll coordination. Catch-up/clean-up is quoted separately by months behind (one-time).

Want your exact price in 10 minutes? Call or text QUOTE to (432) 315-2982.

Can you start if I’m months behind?

Yes. We quote catch-up/clean-up separately, get you current, and then move you to a normal monthly plan.

Do you do taxes?

We’re bookkeeping-first. We coordinate with your CPA/EA for tax prep and can refer trusted partners.

How do payments work?

We keep a card/ACH on file and auto-draft monthly. It’s month-to-month with a 30-day cancel policy.

How fast is onboarding?

Once we have access (QBO Accountant invite or last 3 months of statements), setup typically takes less 24 hours.

What to Do Next

Getting a real number is simple and fast:

Option A: Invite us to

QuickBooks Accountant.

Option B: Send the

last 3 months of bank and credit card statements (PDF is fine).

We’ll review your setup and send a clear, flat monthly quote—no surprises.